Note

Download this Jupyter notebook and all

data

(unzip next to the ipynb file!).

You will need a Gurobi license to run this notebook, please follow the

license instructions.

Maximizing Utility¶

The standard mean-variance (Markowitz) portfolio selection model determines an optimal investment portfolio that balances risk and expected return. In this notebook, we maximize the utility, which is defined as a weighted linear function of return and risk that can be adjusted by varying the risk-aversion coefficient \(\gamma\). Please refer to the annotated list of references for more background information on portfolio optimization.

[2]:

import gurobipy as gp

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

Input Data¶

The following input data is used within the model:

\(S\): set of stocks

\(\mu\): vector of expected returns

\(\Sigma\): PSD variance-covariance matrix

\(\sigma_{ij}\) covariance between returns of assets \(i\) and \(j\)

\(\sigma_{ii}\) variance of return of asset \(i\)

[4]:

# Import example data

Sigma = pd.read_pickle("sigma.pkl")

mu = pd.read_pickle("mu.pkl")

Formulation¶

The model maximizes the investor’s expected utility, which is defined as a linear combination of the expected return and risk, accounting for the investor’s level of risk aversion via the risk-aversion coefficient \(\gamma\). Mathematically, this results in a convex quadratic optimization problem.

Decision Variables and Variable Bounds¶

The decision variables in the model are the proportions of capital invested among the considered stocks. The corresponding vector of positions is denoted by \(x\) with its component \(x_i\) denoting the proportion of capital invested in stock \(i\).

Each position must be between 0 and 1; this prevents leverage and short-selling:

Constraints¶

The budget constraint ensures that all capital is invested:

Objective Function¶

The objective is to maximize expected utility:

Using gurobipy, this can be expressed as follows:

[5]:

%%capture

gamma = 0.2 # risk-aversion coefficient

# Create an empty optimization model

m = gp.Model()

# Add variables: x[i] denotes the proportion invested in stock i

# 0 <= x[i] <= 1

x = m.addMVar(len(mu), lb=0, ub=1, name="x")

# Budget constraint: all investments sum up to 1

m.addConstr(x.sum() == 1, name="Budget_Constraint")

# Define objective function: Maximize expected utility

m.setObjective(

mu.to_numpy() @ x - gamma / 2 * (x @ Sigma.to_numpy() @ x), gp.GRB.MAXIMIZE

)

We now solve the optimization problem:

[6]:

m.optimize()

Gurobi Optimizer version 11.0.3 build v11.0.3rc0 (linux64 - "Ubuntu 24.04.1 LTS")

CPU model: AMD EPYC 7763 64-Core Processor, instruction set [SSE2|AVX|AVX2]

Thread count: 1 physical cores, 2 logical processors, using up to 2 threads

WLS license 2443533 - registered to Gurobi GmbH

Optimize a model with 1 rows, 462 columns and 462 nonzeros

Model fingerprint: 0xee0d2d3c

Model has 106953 quadratic objective terms

Coefficient statistics:

Matrix range [1e+00, 1e+00]

Objective range [7e-02, 6e-01]

QObjective range [6e-04, 2e+01]

Bounds range [1e+00, 1e+00]

RHS range [1e+00, 1e+00]

Presolve time: 0.03s

Presolved: 1 rows, 462 columns, 462 nonzeros

Presolved model has 106953 quadratic objective terms

Ordering time: 0.01s

Barrier statistics:

Free vars : 461

AA' NZ : 1.065e+05

Factor NZ : 1.070e+05 (roughly 1 MB of memory)

Factor Ops : 3.298e+07 (less than 1 second per iteration)

Threads : 1

Objective Residual

Iter Primal Dual Primal Dual Compl Time

0 -2.00616666e+05 3.17727204e+05 2.51e+05 6.60e-01 2.50e+05 0s

1 -5.25149343e+04 5.58459714e+04 6.22e+03 8.36e-06 6.71e+03 0s

2 -2.65726609e+02 7.78009938e+02 4.96e+01 6.66e-08 5.53e+01 0s

3 -4.60705379e-01 4.99493868e+02 4.96e-05 2.51e-13 5.41e-01 0s

4 -4.59350933e-01 1.20162017e+00 1.10e-07 8.19e-14 1.80e-03 0s

5 -1.54241215e-01 2.91476155e-01 1.82e-09 1.10e-15 4.82e-04 0s

6 -4.12662983e-02 1.32695352e-01 3.60e-10 5.60e-16 1.88e-04 0s

7 1.83691636e-02 9.82785660e-02 1.17e-15 2.22e-16 8.65e-05 0s

8 3.61099995e-02 6.40567918e-02 4.44e-16 3.86e-16 3.02e-05 0s

9 4.48593368e-02 5.16994956e-02 1.11e-15 2.78e-16 7.40e-06 0s

10 4.95311895e-02 4.99140985e-02 8.33e-16 2.22e-16 4.14e-07 0s

11 4.98537626e-02 4.98596976e-02 2.04e-15 2.22e-16 6.42e-09 0s

12 4.98589567e-02 4.98590574e-02 7.40e-14 3.33e-16 1.09e-10 0s

13 4.98590130e-02 4.98590195e-02 2.57e-11 2.22e-16 7.02e-12 0s

Barrier solved model in 13 iterations and 0.30 seconds (0.78 work units)

Optimal objective 4.98590130e-02

Display basic solution data:

[7]:

print(f"Expected utility: {m.ObjVal:.6f}")

print(f"Minimum risk: {x.X @ Sigma @ x.X:.6f}")

print(f"Expected return: {mu @ x.X:.6f}")

print(f"Solution time: {m.Runtime:.2f} seconds\n")

# Print investments (with non-negligible values, i.e., > 1e-5)

positions = pd.Series(name="Position", data=x.X, index=mu.index)

print(f"Number of trades: {positions[positions > 1e-5].count()}\n")

print(positions[positions > 1e-5])

Expected utility: 0.049859

Minimum risk: 2.158448

Expected return: 0.265704

Solution time: 0.31 seconds

Number of trades: 31

KR 0.034830

PGR 0.065161

CME 0.028440

ODFL 0.036042

BDX 0.017070

MNST 0.007179

BR 0.000587

KDP 0.082626

GILD 0.007109

META 0.009800

CLX 0.046154

SJM 0.016280

PG 0.000209

LLY 0.128341

DPZ 0.054559

MKTX 0.019685

CPRT 0.003112

MRK 0.030562

ED 0.075457

WST 0.023671

TMUS 0.045910

NOC 0.024011

EA 0.001504

MSFT 0.012608

WM 0.050311

TTWO 0.041694

WMT 0.058436

NVDA 0.009023

HRL 0.031236

AZO 0.019366

CPB 0.019025

Name: Position, dtype: float64

Efficient Frontier¶

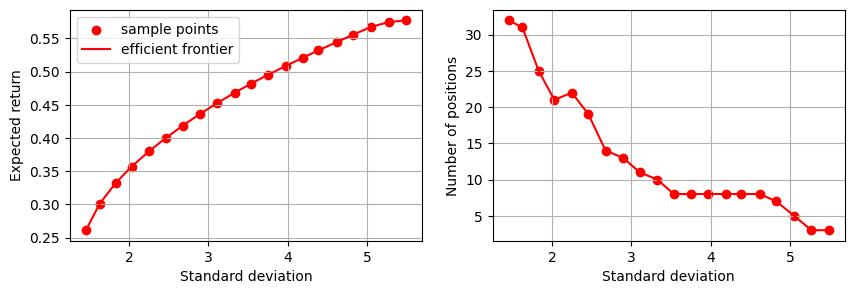

The efficient frontier reveals the balance between risk and return in investment portfolios. It shows the best-expected risk level that can be achieved for a specified return level. We compute this by solving the above optimization problem for a sample of risk aversion levels \(\gamma\).

[8]:

# Hand picked for approximately equidistant return/risk points

# fmt: off

gamma_vals = np.array([

2.00e-03,3.10e-03,9.67e-03,1.10e-02,1.17e-02,1.26e-02,1.35e-02,1.47e-02,1.62e-02,1.81e-02,

2.05e-02,2.36e-02,2.69e-02,3.12e-02,3.69e-02,4.39e-02,5.52e-02,7.36e-02,1.10e-01,2.21e-01,])

# fmt: on

returns = np.zeros(gamma_vals.shape)

risks = np.zeros(gamma_vals.shape)

npos = np.zeros(gamma_vals.shape)

utility = []

# prevent Gurobi log output

m.params.OutputFlag = 0

# solve the model for each risk level

for i, gamma in enumerate(gamma_vals):

# Replace utility objective function according to this choice for gamma

m.setObjective(

mu.to_numpy() @ x - gamma / 2.0 * (x @ Sigma.to_numpy() @ x), gp.GRB.MAXIMIZE

)

m.optimize()

utility.append(m.objval)

# store data

returns[i] = mu @ x.X

risks[i] = np.sqrt(x.X @ Sigma @ x.X)

npos[i] = len(x.X[x.X > 1e-5])

Next, we display the efficient frontier for this model: We plot the expected returns (on the \(y\)-axis) against the standard deviation \(\sqrt{x^\top\Sigma x}\) of the expected returns (on the \(x\)-axis). We also display the relationship between the risk and the number of positions in the optimal portfolio.

[9]:

fig, axs = plt.subplots(1, 2, figsize=(10, 3))

# Axis 0: The efficient frontier

axs[0].scatter(x=risks, y=returns, marker="o", label="sample points", color="Red")

axs[0].plot(risks, returns, label="efficient frontier", color="Red")

axs[0].set_xlabel("Standard deviation")

axs[0].set_ylabel("Expected return")

axs[0].legend()

axs[0].grid()

# Axis 1: The number of open positions

axs[1].scatter(x=risks, y=npos, color="Red")

axs[1].plot(risks, npos, color="Red")

axs[1].set_xlabel("Standard deviation")

axs[1].set_ylabel("Number of positions")

axs[1].grid()

plt.show()

As expected, the number of open positions decreases as we allow more variance; the optimization will progressively invest in fewer high-risk but high-yield assets.