Note

Download this Jupyter notebook and all

data

(unzip next to the ipynb file!).

You will need a Gurobi license to run this notebook, please follow the

license instructions.

Minimizing Variance¶

The standard mean-variance (Markowitz) portfolio selection model determines an optimal investment portfolio that balances risk and expected return. In this notebook, we minimize the variance (risk) of the portfolio, constraining the expected return to meet a prescribed minimum level. Please refer to the annotated list of references for more background information on portfolio optimization.

[2]:

import gurobipy as gp

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

Input Data¶

The following input data is used within the model:

\(S\): set of stocks

\(\mu\): vector of expected returns

\(\Sigma\): PSD variance-covariance matrix

\(\sigma_{ij}\) covariance between returns of assets \(i\) and \(j\)

\(\sigma_{ii}\) variance of return of asset \(i\)

[4]:

# Import example data

Sigma = pd.read_pickle("sigma.pkl")

mu = pd.read_pickle("mu.pkl")

Formulation¶

The model minimizes the variance of the portfolio, given that a prescribed minimum level of expected return is attained. Mathematically, this results in a convex quadratic optimization problem.

Decision Variables and Variable Bounds¶

The decision variables in the model are the proportions of capital invested among the considered stocks. The corresponding vector of positions is denoted by \(x\) with its component \(x_i\) denoting the proportion of capital invested in stock \(i\).

Each position must be between 0 and 1; this prevents leverage and short-selling:

Constraints¶

The budget constraint ensures that the entire capital is invested:

The expected return of the portfolio must be at least \(\bar\mu\):

Objective Function¶

The objective is to minimize the risk of the portfolio, which is measured by its variance:

Using gurobipy, this can be expressed as follows:

[5]:

mu_bar = 0.5 # Required return

# Create an empty optimization model

m = gp.Model()

# Add variables: x[i] denotes the proportion of capital invested in stock i

# 0 <= x[i] <= 1

x = m.addMVar(len(mu), lb=0, ub=1, name="x")

# Budget constraint: all investments sum up to 1

m.addConstr(x.sum() == 1, name="Budget_Constraint")

# Lower bound on expected return

ret_constr = m.addConstr(mu.to_numpy() @ x >= mu_bar, name="Min_Return")

# Define objective function: Minimize overall risk

m.setObjective(x @ Sigma.to_numpy() @ x, gp.GRB.MINIMIZE)

We now solve the optimization problem:

[6]:

m.optimize()

Gurobi Optimizer version 11.0.3 build v11.0.3rc0 (linux64 - "Ubuntu 24.04.1 LTS")

CPU model: AMD EPYC 7763 64-Core Processor, instruction set [SSE2|AVX|AVX2]

Thread count: 1 physical cores, 2 logical processors, using up to 2 threads

WLS license 2443533 - registered to Gurobi GmbH

Optimize a model with 2 rows, 462 columns and 924 nonzeros

Model fingerprint: 0x91dc4a17

Model has 106953 quadratic objective terms

Coefficient statistics:

Matrix range [7e-02, 1e+00]

Objective range [0e+00, 0e+00]

QObjective range [6e-03, 2e+02]

Bounds range [1e+00, 1e+00]

RHS range [5e-01, 1e+00]

Presolve time: 0.03s

Presolved: 2 rows, 462 columns, 924 nonzeros

Presolved model has 106953 quadratic objective terms

Ordering time: 0.01s

Barrier statistics:

Free vars : 461

AA' NZ : 1.070e+05

Factor NZ : 1.074e+05 (roughly 1 MB of memory)

Factor Ops : 3.319e+07 (less than 1 second per iteration)

Threads : 1

Objective Residual

Iter Primal Dual Primal Dual Compl Time

0 8.01646707e+05 -8.01646707e+05 4.62e+05 2.79e-04 2.51e+05 0s

1 2.62320026e+04 -2.76760257e+04 3.64e+03 2.20e-06 1.99e+03 0s

2 4.08317831e+02 -2.00650283e+03 1.98e+01 1.19e-08 1.15e+01 0s

3 1.67175634e+01 -1.37940884e+03 4.78e-01 2.89e-10 6.30e-01 0s

4 2.23958857e+01 -4.30707773e+02 4.78e-07 3.33e-16 1.22e-01 0s

5 1.92443494e+01 5.94640841e+00 5.77e-09 1.11e-16 3.59e-03 0s

6 1.67030106e+01 1.38408810e+01 4.55e-10 2.22e-16 7.74e-04 0s

7 1.52179879e+01 1.45858210e+01 4.67e-14 3.55e-15 1.71e-04 0s

8 1.46942705e+01 1.46770325e+01 2.30e-13 2.87e-15 4.66e-06 0s

9 1.46790601e+01 1.46790425e+01 6.18e-13 1.78e-15 4.75e-09 0s

10 1.46790446e+01 1.46790446e+01 2.62e-13 6.86e-15 4.75e-12 0s

Barrier solved model in 10 iterations and 0.27 seconds (0.63 work units)

Optimal objective 1.46790446e+01

Display basic solution data:

[7]:

print(f"Minimum risk: {m.ObjVal:.6f}")

print(f"Expected return: {mu @ x.X:.6f}")

print(f"Solution time: {m.Runtime:.2f} seconds\n")

# Print investments (with non-negligible value, i.e., > 1e-5)

positions = pd.Series(name="Position", data=x.X, index=mu.index)

print(f"Number of trades: {positions[positions > 1e-5].count()}\n")

print(positions[positions > 1e-5])

Minimum risk: 14.679045

Expected return: 0.500000

Solution time: 0.27 seconds

Number of trades: 8

TSLA 0.128472

AMD 0.017131

AVGO 0.070706

DXCM 0.035290

NFLX 0.051834

LLY 0.200962

ENPH 0.080654

NVDA 0.414950

Name: Position, dtype: float64

Efficient Frontier¶

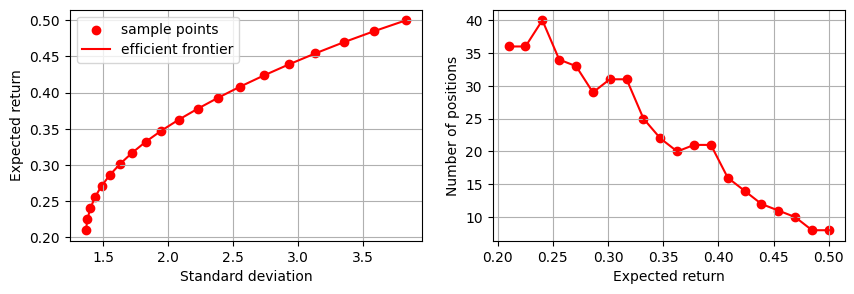

The efficient frontier reveals the balance between risk and return in investment portfolios. It shows the best-expected risk level that can be achieved for a specified minimum return level. We compute this by solving the above optimization problem for a sample of admissible return levels.

[8]:

returns = np.linspace(0.21, 0.5, 20)

risks = np.zeros(returns.shape)

npos = np.zeros(returns.shape)

# Hide Gurobi log output

m.params.OutputFlag = 0

# Solve the model for each risk level

for i, ret in enumerate(returns):

# Modify lower bound on expected return

ret_constr.RHS = ret

m.optimize()

# Store data

risks[i] = np.sqrt(x.X @ Sigma @ x.X)

npos[i] = len(x.X[x.X > 1e-5])

We can display the efficient frontier to visualize the relationship between the expected return and the variance. We also display the relationship between the return and the number of positions in the optimal portfolio.

[9]:

fig, axs = plt.subplots(1, 2, figsize=(10, 3))

# Axis 0: The efficient frontier

axs[0].scatter(x=risks, y=returns, marker="o", label="sample points", color="Red")

axs[0].plot(risks, returns, label="efficient frontier", color="Red")

axs[0].set_xlabel("Standard deviation")

axs[0].set_ylabel("Expected return")

axs[0].legend()

axs[0].grid()

# Axis 1: The number of open positions

axs[1].scatter(x=returns, y=npos, color="Red")

axs[1].plot(returns, npos, color="Red")

axs[1].set_xlabel("Expected return")

axs[1].set_ylabel("Number of positions")

axs[1].grid()

plt.show()

As expected, the number of open positions decreases as we enforce higher returns; the optimization will progressively invest in fewer high-risk but high-yield assets.